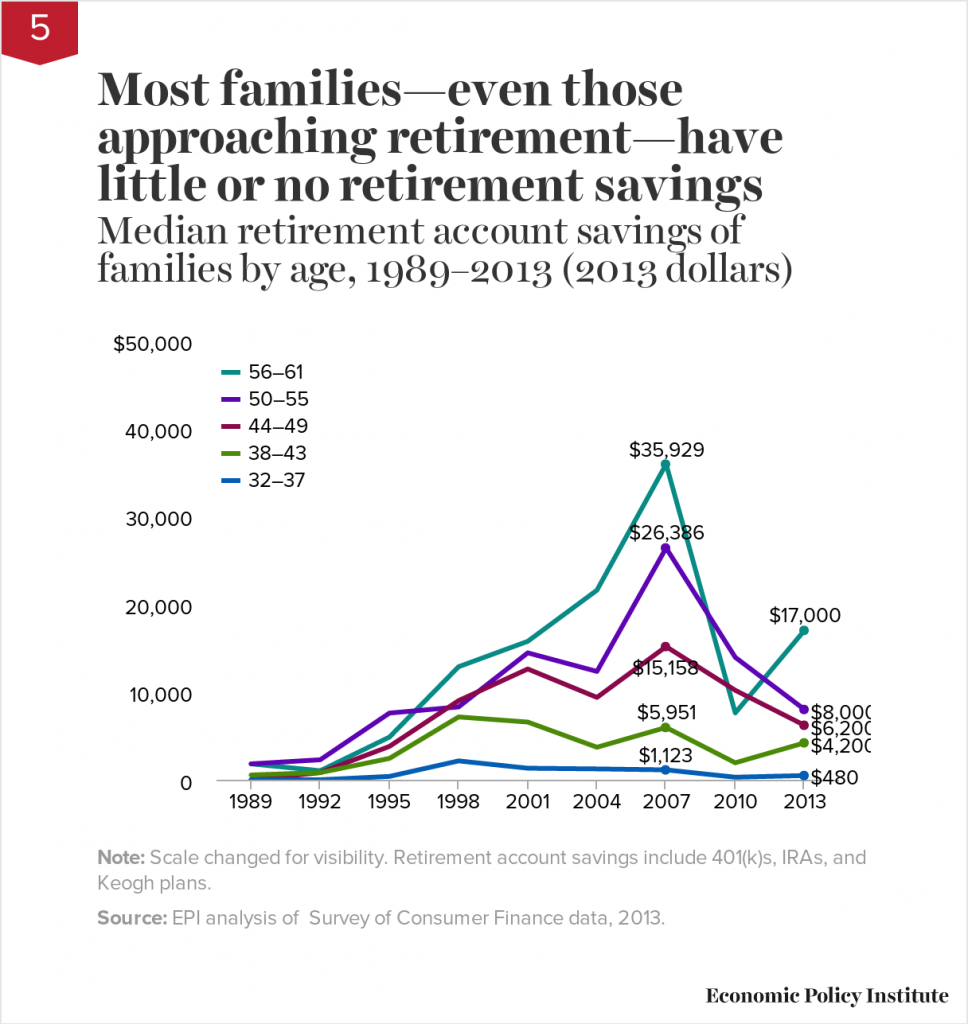

When it comes to personal savings, retirement savings in particular, Americans have not fared well. According to an Economic Policy Institute study on the state of American retirement in 2013, almost half of American families have no retirement savings. The median (50th percentile) retirement savings for working age families between the ages 32-37 is $480 and $17,000 for families closest to retirement. Check out the chart below:

While “the sooner you start investing for your future the less daunting of a task it becomes” has always been true, it is not too late to focus on saving. Even a small commitment to saving now will help you begin to develop disciplined saving and spending habits. Sometimes the hardest part is just figuring out how to get started. Not sure how to get started, we can give you a hand!

While “the sooner you start investing for your future the less daunting of a task it becomes” has always been true, it is not too late to focus on saving. Even a small commitment to saving now will help you begin to develop disciplined saving and spending habits. Sometimes the hardest part is just figuring out how to get started. Not sure how to get started, we can give you a hand!

IMPORTANT DISCLOSURES This letter may include forward-looking statements. All statements other than statements of historical fact are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements.” Performance is not indicative of any specific investment or future results. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. Investment in securities, including mutual funds, involves the risk of loss. Nothing in this letter is intended to be or should be construed as individualized investment advice. All content is of a general nature. Individual investors should consult their investment adviser, accountant, and/or attorney for specifically tailored advice.